Intelligent Automation (IA) Tools have become a key enabler for enterprises to traverse digital transformation journey, expanding automation scope beyond IT and enterprise-centric to industry-specific automation.

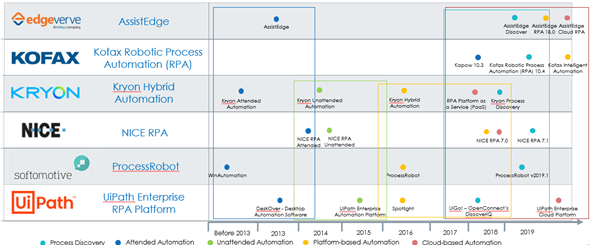

This excerpt showcases the IA tools vendor landscape, their evolution path and key differentiating capabilities.

Introduction

With the introduction of contact centers in the 1990s, the focus of enterprises moved towards enhancing customer experiences and addressing customer service requests, including billing inquiries, address change, claim adjustments among others. Along with this also changed the enterprises’ automation requirements, and eventually expanded their focus from internal and back-office tasks to front office and customer-facing areas.

Seeing the success in the back-end and customer-facing roles, enterprises have started evaluating some of the automation tools for industry-specific processes which involve core, more complex and judgement-intensive use cases. These include risk profiling, fraud detection, real-time reconciliation, advanced recommendations and proactive regulatory compliance.

This shift in the focus towards business-critical processes led enterprises to adopt combinations of digital technologies such as RPA and AI, including Machine Learning, NLP, intent engine, and cognitive abilities, to simplify routine tasks and free-up workforce for more critical and customer-facing roles.

Tool vendors being cognizant about above trend have augmented their automation suite to offer an integrated platform that enables end to end automation. Additionally, tool vendors also updated their branding, positioning, and messaging. For instance, Kofax moved away from “capture company” to an “integrated intelligent automation platform provider”, NICE transitioned from a product company (RPA centric) to an enterprise software provider driving focus in customer engagement segment, while IPsoft expanded from IT automation to a virtual agent to more of a holistic solution vendor by bringing RPA.

IA Tools Evolved Over A Period of Time

By taking an enterprise-centric view from a buyer perspective on what intelligent automation would mean for them, IA tool vendors continue to add different automation capabilities and fill-in the gaps either by themselves (through backward or forward integration) or from outside (through partnerships or acquisition route).

One of the prominent trends which emerged was the introduction of cloud-based automation platform. The demand for cloud solutions is on the rise, mostly from small and mid-size organizations, as it provides a flexible and cost-effective deployment model. This trend is also picking up in large enterprises as cloud providers improve their capabilities around security and scalability.

Seeing this growing inclination towards cloud, tool vendors started introducing a cloud-based platform starting 2018 and invest in transitioning from legacy on-prem model to cloud-based subscription model. Additionally, to comply with the client environment, many vendors not only entered into a strategic partnership with some of the leading cloud providers, including AWS, Google Cloud, IBM Cloud, Microsoft Azure, and Oracle Cloud, but also attained their certification. One of the major acquisitions to be called out here was that of Thoughtonomy by Blue Prism. It helped Blue Prism strengthen its cloud delivery capabilities and subsequently add an as-a-service commercial model.

Further, tool vendors brought process discovery late in the cycle to cover the entire automation value chain. This not only brought unbiasedness in the entire process of prioritizing the processes for automation but also help enterprises develop an automation strategy and roadmap. For instance, last year Kryon launched its process discovery solution, which uses AI analytics engine to generate a picture of business processes, evaluate and recommend either attended (i.e. desktop), or unattended (virtual-machine-based) solution.

Preparing for the Next Phase of Automation

As tool vendors gear-up for the next phase of automation, which entails taking automation solution to more complex, decision-making, and industry-specific core processes, vendors are investing in primarily three capabilities:

- BPM integration: To offer an integrated user experience, many vendors are enhancing BPM /RPA process integration. Moreover, vendors like IPsoft, which already had strong AI capabilities built-in, it made sense for them to add RPA components that can be integrated into the BPM to enhance user experience.

Players who started their journey as pure-play RPA providers collaborated with BPM providers to offer an integrated platform. For instance, UiPath collaborated with Bonitasoft, while Blue Prism partnered with Bizagi to deliver an intelligent automation solution to streamline enterprise operations.

- Data capture: As enterprises are evolving and embracing automation tools for industry-specific/business-critical processes, the data capture capability has come to the fore and has become one of the prime criteria. This was with a realization that RPA or IT automation fails in some business-critical scenarios; hence, the vendors prefer investing in cognitive capture capabilities to stand-out in the market. For instance, Blue Prism recently added Tabscanner to its Technology Alliance Program (TAP) to integrate its feature to convert images of receipts into classified data. Also, Softomotive entered into a strategic partnership with CaptureFast to assess information from physical or digital documents via AI using machine print character recognition.

- Chatbot/Virtual Assistants: As the customer service industry moves towards chat/messaging instead of voice interaction, many vendors are investing in digital messaging capabilities and adding chatbot or virtual assistants in their solution portfolio. For instance, Pegasystems Customer Service acquired a digital messaging platform In The Chat (ITC), that unifies text messaging, social media, live chat, email, messengers, and chatbots for a conversation with customers. Further, Verint Systems recently added anomaly detection to its VoC solutions (built upon Verint Text Analytics and Verint Speech Analytics) to help companies automate insights.

Conclusion

As the intelligent automation space gets convoluted with more and more vendors coming to the fore from varied streams (RPA, conversational AI, data-centric), enterprises would have to take a hawkish stance while shortlisting right automation partner. This would entail assessing the maturity of the tool’s features and functionalities, ease of deployment, commercial flexibility, support infrastructure, investment approach, and innovation-focus of the vendor among others.

Related: Building a Foundation to Enable Digital Transformation

Related: Choosing the Right Digital partner: Paradigm Evolution in Assessment Approaches

Related: Enabling Transformation in the Digital Economy

Related: Leveraging IT-BPO Convergence for Enterprise Digital Transformation