Software Defined - Wide Area Network (SD-WAN) has become a key enabler for enterprise network optimization and flexible transformation. SD-WAN offers a compelling case for globally dispersed enterprises with growing network complexities, providing the ability to offer improved customer experience.

This excerpt showcases industry trends around SD-WAN managed services and provides recommendations that can potentially answer business customers' WAN requirements. Further, the excerpt helps enterprises to define their SD-WAN strategy, develop use-cases and move from conducting proof-of-concepts to real-time SD-WAN deployment.

Introduction

Avasant SD-WAN Managed Services RadarView™ covers service providers with end-to-end offerings spanning network management, network security, performance management and support of physical and virtual customer premise equipment (CPE).

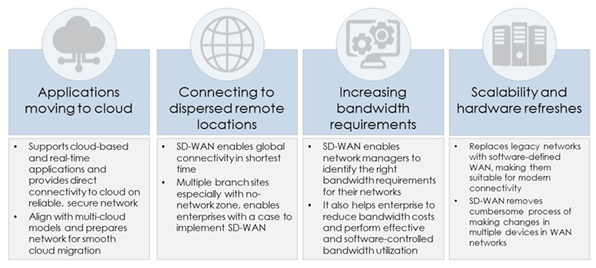

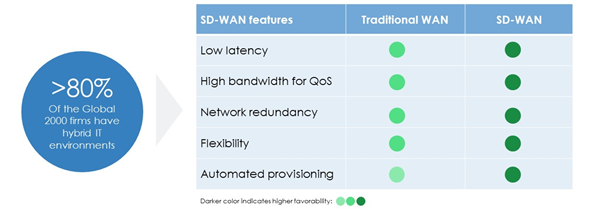

SD-WAN primarily helps enterprises with concerns around increasing workloads in the cloud, connecting dispersed remote locations, bandwidth requirements, and need for scale and hardware refresh. SD-WAN, when compared with traditional WAN architecture offers significant cost savings, a high level of quality-of-service (QoS), zero-touch configuration and full visibility into real-time network management.

SD-WAN makes a compelling case for globally dispersed enterprises with growing network complexities

Key Industry Trends

The adoption of SD-WAN Managed Services technology to enhance network performance and improve bandwidth utilization is growing across industries. There is significant interest among the top Global 2000 companies to explore and understand SD-WAN to transform their networks. Avasant’s interactions with enterprise digital leaders reveal that organizations are working to find the right business case to scale SD-WAN across the enterprise. They are looking to identify service providers that provide a progressive, business-centric approach to support their SD-WAN transformation journey. Here are some of the key trends shaping the SD-WAN ecosystem:

SD-WAN is accelerating and will be mainstream in the next 36 months

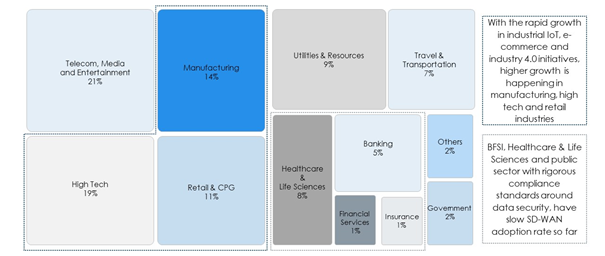

In terms of SD-WAN adoption, around 20% of the global 2000 organizations have replaced their proprietary hardware and replaced it with SD-WAN technology, which offers more flexible, open, and cloud-based WAN technologies. Among these, industries requiring high bandwidth such as Telecom, Media & Communication and globally dispersed, such as Manufacturing (including high tech), and Retail & CPG (together constitute 65% of the total SD-WAN revenue) have been early adopters of SD-WAN. Highly regulated industries like healthcare and BFSI are slowly gaining momentum. More than 45% of the Global 2000 companies are planning to deploy SD-WAN in the next 24 months.

TMT and High Tech are early adopters and constitute more than a quarter of SD-WAN implementations

Increasing cloud usage and digital transformation has led to new network design requirements

A noticeable trend in enterprise networking is the increased adoption of hybrid-cloud strategy (which includes a mix of private, public cloud and on-premise). With more than 80% of the Global 2000 organizations moving to a hybrid cloud environment, it requires advanced network topologies and capabilities.

SD-WAN provides the mechanism to support increasing workloads, with improved security and centralized management across numerous locations. As a result, leading cloud providers like AWS, Google Cloud and Microsoft Azure have started to build partnerships with SD-WAN technology providers, providing seamless and secure cloud support and faster access to cloud-based applications. For instance, in April 2019 Google entered into a strategic partnership with Citric to extend their networks to the cloud and deliver applications in an agile manner. Also, it allows Google to offer Citrix SD-WAN and Citrix ADC on the Google Cloud platform (GCP) marketplace through its SD-WAN appliances and help clients to deploy multiple SaaS, cloud, virtual, web and microservices-based apps.

As enterprise applications are becoming cloud ready, it requires new WAN topology to support it

Digital initiatives are driving SD-WAN tech enhancements

Increased usage of new-age technologies like AI, IoT, and big data/analytics, which require efficient bandwidth utilization and network agility to support growing traffic, have experienced accelerated SD-WAN adoption. To accommodate this, service providers in conjunction with leading SD-WAN technology providers are offering new features including network analytics, predictive maintenance, auto-healing, etc. These help enterprises improve network resilience, resolution time, and business agility. Some of the recently launched integrated platforms include Cisco AI Network Analytics (AI/ML), Citrix Analytics (Analytics, VMware Smart Experience (AI/ML), Cisco IR1101 router (IoT), Versa Director (Intelligent Automation), etc.

The growing SD-WAN Marketplace

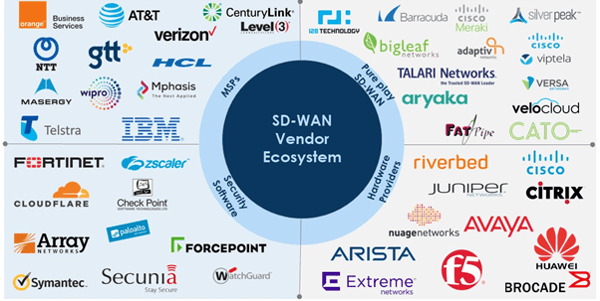

Over the past few years, the SD-WAN startup ecosystem has become vibrant with significant funding and marquee acquisitions from leading technology providers. These leading traditional technology providers are leveraging these acquisitions (with more than a billion dollars in funding and around 6.5x average acquisition value to funding ratio) to acquire IP, rapidly expand capabilities and develop adjacent services. On the other hand, managed service providers such as CenturyLink, DXC, GTT, NTT among others have also taken the inorganic approach.

The entire SD-WAN ecosystem has a large pool of players, including managed service providers, SD-WAN technology providers, hardware providers, and security software providers, addressing different aspects of the value chain.

The SD-WAN ecosystem has a large number of players addressing different aspects of the value chain

Recommendations for enterprises

Identify the clear value-driven business case for SD-WAN

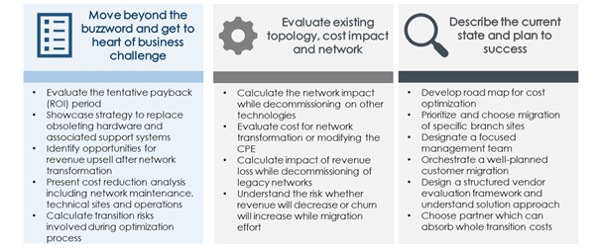

Enterprises looking to invest in SD-WAN need to carefully evaluate technical, design and security considerations around it. Some of the typical SD-WAN implementation challenges include proper business case, exposed security vulnerabilities, cloud unfriendly architecture, complex environment, and lack of SD-WAN related expertise. Among these, having a structured business case signifies a true enterprise approach and accelerate its digital-first SD-WAN migration journey.

Enterprises should prioritize business-centric factors while considering migration to SD-WAN

Leverage phased migration approach for SD-WAN implementation

Additionally, enterprises should always leverage a phased transition approach for SD-WAN adoption. The Enterprise should carry out pilot models to evaluate SD-WAN requirements, understand critical factors needed for a best-fit implementation approach and strategize how to achieve sustainable cost optimization. One these pilots have been migrated, customers can move forward with the transition considering key parameters including – reusing existing architecture, zero business disruption, effective change management and, adoption of best practices.

Choose, select and work with providers who have large and complex implementation experience

Enterprises should seek service providers that have a robust suite of managed services portfolio, diverse partnerships, structured training programs, offer flexible pricing model and extensive global coverage. To address increasing SD-WAN demands, service providers are significantly investing (around 33% of their overall investment budget) towards IP and asset creation. In addition to marquee acquisitions, leading service providers have also developed proprietary SD-WAN platforms such as AT&T (FlexWare), BT (Agile Connect), HCL (NetBot), Masergy (SD-WAN Go), NTT (NTT SD-WAN (, Orange Business Services (Flexible SD-WAN), etc.

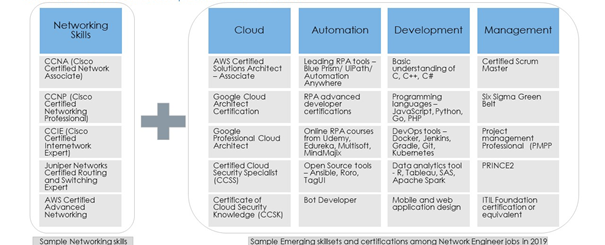

Enterprises are also investing in revamping their hiring process, upskilling teams with cloud management, automation and management skills to address multi-vendor integration and security challenges. Service providers are upskilling and shaping network engineers of the future to embrace software fluency, automation scripting, and management skills to meet business needs for complex network infrastructure.

Enterprises need to upskill Network Engineers with cloud and automation skills in addition to core networking capabilities

invest in next-gen security solutions compliant with new security standards

As SD-WAN becomes central to cloud and IoT applications, both service providers and enterprises need to increase focus on SD-WAN security features, staff certifications, and compliance. With a rise in Cybersecurity breaches in the past 24 months, enterprise and service providers teams need to replace perimeter-based security and upgrade tools capabilities with next-gen security standards based on real-time traffic and business goals. To address enterprise security concerns, ecosystem partners have evolved to develop robust and reliable security solutions such as Fortinet (FortiGate Secure SD-WAN), ZScaler (ZScaler SD-WAN Security), Forcepoint (next-generation firewall (NGFW)), WatchGuard (Total security suite), among others.

Conclusion

Ultimately, both enterprises and service providers need to work together towards a proactive approach for successful SD-WAN implementations and managed services across the spectrum of industry verticals. Enterprises, regardless of how SD-WAN is implemented, will need to evaluate how they can leverage SD-WAN to access granular visibility into network management and troubleshoot complex environments. To achieve SD-WAN success, enterprises need to choose vendors which can provide total cost of ownership (TCO), quality of services (QoS), and smooth knowledge transition.

Learn more about the SD-WAN Managed Services landscape via Avasant's SD-WAN Managed Services RadarView™ report 2019 here.

Download this article as a whitepaper here.